- Exclusive preview of the 2024 airport rankings

Montreal, 14 April 2025 – Airports Council International (ACI) World today offers an exclusive first look at the 2024 rankings of the world’s busiest airports, showcasing their resilience in navigating global uncertainty. Despite geopolitical and economic challenges, these airports have successfully held their top rankings, positioning themselves for continued growth.

Montreal, 14 April 2025 – Airports Council International (ACI) World today offers an exclusive first look at the 2024 rankings of the world’s busiest airports, showcasing their resilience in navigating global uncertainty. Despite geopolitical and economic challenges, these airports have successfully held their top rankings, positioning themselves for continued growth.

ACI World Director General Justin Erbacci said, “Amid global challenges, the resilience of the world’s busiest airports shines. These hubs are vital arteries of trade, commerce, and connectivity. As air travel grows, ACI World stands ready to support its members, ensuring the smooth flow of people and goods that drive global economic, social, and cultural progress.”

Passenger traffic highlights

- Preliminary figures indicate that the 2024 global total passengers are close to 9.5 billion, representing an increase of 9% from 2023 or a gain of 3.8% from pre-pandemic levels (2019).

- The Top 10 busiest airports, representing 9% of global traffic (855 million passengers), witnessed a gain of 8.8% from 2023 and a gain of 8.4% vis-à-vis their 2019 results (789 million pax in 2019).

- Hartsfield-Jackson Atlanta International Airport defends its top position, followed by Dubai International Airport and Dallas Fort Worth International Airport.

- The biggest jump in the Top 10 rankings was recorded for Shanghai Pudong International Airport, going from 21st position in 2023 to the 10th spot in 2024. The jump was fueled by expanded visa policies, the resumption and expansion of international flights, operational enhancements, and the recovery of the Asia-Pacific region, particularly China.

- The unwavering strength of Istanbul Airport and New Delhi International Airport keep them in top ranks, marking significant progress over 2019. Both airports have been thriving due to airline expansion, infrastructure growth, and enhanced global connectivity.

Navigating global uncertainty

Navigating global uncertainty

2024 saw global passenger growth face significant uncertainties that stemmed from evolving economic and geopolitical landscapes. Ongoing supply chain challenges and production delays from aircraft manufacturers, as well as geopolitical tensions, posed a risk to growth opportunities by potentially altering flight routes, increasing operational costs, and affecting passenger sentiment. Additionally, the threat of tariffs raised concerns about potential disruptions to global trade, which indirectly affected international travel demand and increased constructions.

In 2025, global passenger traffic is forecast to reach 9.9 billion with a 4.8% year-over-year growth rate. While passenger demand remains strong, the pace of expansion is expected to slow as markets shift from recovery-driven surges to structural, long-term growth patterns.

Key challenges such as economic uncertainty, geopolitical tensions, and capacity constraints are expected to increasingly shape the industry’s trajectory. In advanced markets, demand stabilization, supply chain bottlenecks in aircraft production and airport capacity shortage may temper growth, while in emerging markets, higher infrastructure investment and rising middle-class travel demand will likely continue to drive expansion. As the industry moves into a new era of growth, the airport industry must focus on financial viability, investment in infrastructure, operational efficiency, and sustainability.

Cargo traffic highlights

Cargo traffic highlights

- Air cargo volumes are estimated to have increased by 8.4% year-over-year (+3.9% versus 2019), to over 124 million metric tonnes in 2024.

- Air cargo volumes in the top 10 airports–representing close to 26% (32.3 million metric tonnes) of the global volumes in 2024—gained 9.3% in 2024 year-over-year or a gain of 9.5% vis-à-vis their 2019 results (29.5 million tonnes in 2019). Air cargo traffic is more concentrated amongst the main airports.

- The increase in cargo is attributed mainly to strong e-commerce demand, maritime shipping disruptions, and declines in jet fuel prices.

- Hong Kong International Airport remained the top rank, followed by Shanghai Pudong International Airport and Memphis International Airport.

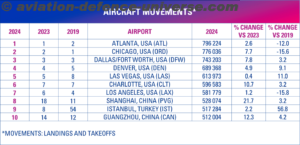

Aircraft movements

Aircraft movements

- 2024 global aircraft movements are estimated to be around 100 million, representing a gain of 4.3% from 2023 or -2.6% vs 2019 (i.e., a recovery of 97.4%).

- The Top 10 airports representing over 6% of global traffic (6.4 million movements), witnessed a gain of 6.5% from their 2023 results or a slight gain of 0.4% vis-à-vis their 2019 results (6.3 million).

- Hartsfield-Jackson Atlanta International Airport is at the top, followed by Chicago O’Hare International Airport and Dallas Fort Worth International Airport.