- Singapore’s Reign as MRO Hub: Lessons for India’s Aviation Ambitions

- Can India Compete with Singapore’s Aviation Stronghold?

By Sangeeta Saxena

New Delhi. 24 September 2024. Impossible is a word in the dictionary of fools said Napoleon Bonaparte and no other quote could answer the above question better. As the sun is set to rise across the Singapore Strait in a few hours from now and countdown to the MRO Asia-Pacific is also coming to an end, one thought which can never surprise nor seem alien is the fact that Singapore has long established itself as one of the premier aviation maintenance, repair, and overhaul (MRO) hubs in the world, playing a critical role in the Asia-Pacific region’s aviation industry.

Leveraging its strategic geographical location, world-class infrastructure, and pro-business environment, Singapore has consistently been a leader in the global MRO sector. The country’s position as an MRO hub is complemented by the annual MRO Asia-Pacific Conference, which has become an essential platform for stakeholders to discuss industry trends, technological innovations, and future growth strategies.

Singapore’s success as an MRO hub can be attributed to its highly skilled workforce, supported by government initiatives to invest in technical education and training programs. Institutions like the Air Transport Training College (ATTC) and collaborations with local universities ensure a steady pipeline of trained aviation professionals. Moreover, Singapore has focused on fostering expertise in next-generation technologies, such as robotics, AI-based predictive maintenance, and digital twins, further bolstering its competitiveness.

The MRO Asia-Pacific Conference, held annually in Singapore, is one of the most significant events for the region’s aviation industry. The conference brings together key stakeholders from across the aviation value chain, including airlines, OEMs, MRO service providers, and regulators. The importance of this conference lies in its role as a platform for discussing current challenges, future trends, and innovative solutions that can shape the future of the MRO industry.

The MRO Asia-Pacific Conference provides an unparalleled networking platform for industry professionals. Decision-makers from airlines, OEMs, and MRO providers have the opportunity to collaborate on emerging technologies and share best practices. These interactions often result in strategic partnerships, joint ventures, and business deals that drive the growth of the MRO industry across the region. The aviation industry is increasingly reliant on cutting-edge technologies to improve operational efficiency, reduce costs, and enhance safety. The MRO Asia-Pacific Conference serves as a showcase for the latest innovations, such as predictive maintenance powered by big data, digital twin technology for real-time monitoring, and AI-driven automation in maintenance procedures. For Singapore’s MRO industry, the conference is an opportunity to demonstrate its leadership in adopting and integrating these technologies into its services.

The Asia-Pacific region is one of the fastest-growing aviation markets in the world, with rapid fleet expansion and increasing passenger traffic forecasted in the coming years. The MRO Asia-Pacific Conference allows stakeholders to plan for the rising demand for MRO services by analyzing market trends, discussing capacity building, and exploring the potential for regional hubs to support this growth. Singapore, being a central player in the region, uses the conference to cement its role as the leading MRO hub for Asia-Pacific aviation.

In conclusion, Singapore’s strategic location, world-class infrastructure, skilled workforce, and government support have cemented its position as a global leader in the MRO sector. The MRO Asia-Pacific Conference serves as a critical annual event that fosters collaboration, drives innovation, and addresses key challenges in the aviation maintenance industry. As the aviation sector continues to evolve, Singapore remains at the forefront, shaping the future of MRO services in the Asia-Pacific region and beyond.

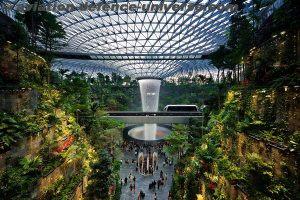

While both Singapore and India are key players in the global aviation industry, Singapore has established itself as a more prominent MRO hub for several reasons. However, India has immense potential to develop into a significant MRO destination as well. Strategic location and Aviation connectivity make both the countries potential players in MRO arena. Singapore’s geographical location at the crossroads of major air routes between Europe, Asia, and the Pacific has allowed it to become a convenient stopover for airlines. This makes it an ideal location for MRO services as airlines can integrate maintenance into their existing flight schedules with minimal disruption. Singapore’s Changi Airport is a major global aviation hub, with over 100 airlines connecting to more than 400 cities, making it highly accessible for both international and regional operators. India also enjoys a strategic location between Europe and Southeast Asia, making it geographically advantageous for the MRO sector. However, its potential remains underutilized.

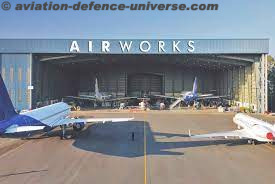

India’s MRO infrastructure is still in development, and while there are some high-quality facilities, they are fewer in number compared to Singapore. Major Indian MRO companies are growing but need substantial investment in technology and capacity to compete on the global stage. Furthermore, airport congestion in key cities like Delhi and Mumbai makes it challenging to integrate large-scale MRO operations seamlessly into daily air traffic.

Singapore offers a pro-business environment with transparent, efficient regulations and attractive tax policies, making it easier for global companies to operate MRO facilities. Zero GST on aircraft maintenance services and minimal import duties on aircraft parts provide additional financial incentives for airlines to base their MRO operations in Singapore.

India has historically faced challenges with its complex regulatory and tax framework, including high Goods and Services Tax (GST) rates on MRO services and customs duties on spare parts. This made it financially unviable for many airlines to conduct MRO work domestically, prompting them to look for options abroad. Recent reforms, such as reducing GST from 18% to 5% on MRO services and removing customs duties on spare parts, have aimed to make India more competitive. However, the changes are relatively new, and more comprehensive reforms are needed to create a smoother regulatory environment.

Singapore has a well-established ecosystem of highly skilled aviation professionals, supported by a robust education and training system, with institutions like the Air Transport Training College (ATTC). The government also actively promotes talent development through specialized courses and collaboration with the industry. The country emphasizes continuous upskilling, which ensures its workforce remains adept with the latest technologies in aviation. India has a large pool of talented engineers and technicians, but skilled manpower in the aviation sector still requires further development. The country’s MRO workforce often faces gaps in technical expertise and training, especially when it comes to working with modern, next-generation aircraft systems. Indian institutions are focusing on building capacity through aviation training programs, but a more coordinated and industry-aligned approach is needed to scale the required talent.

While Singapore’s domestic aviation market is relatively small, it capitalizes on its regional and international appeal. The country primarily serves as a regional MRO hub for airlines across Asia-Pacific and the Middle East, allowing it to command a global market despite its size. India’s aviation market is one of the fastest-growing in the world, with increasing air traffic and fleet expansions. India’s potential to become an MRO hub lies in its domestic demand for MRO services, as Indian airlines are rapidly adding new aircraft to their fleets. However, if India can better align its infrastructure and regulatory framework, it could reduce its reliance on foreign MRO facilities and build a robust internal market.

Post Script : As a keen follower of the MRO industry in India, positivity needs to be kept intact but at times reality dawns , which really hits hard. Many of the latest MRO reports highlight a glaring omission-India’s MRO industry-which remains too insignificant to be considered a serious player on the global stage. Combined all Indian MRO companies contribute less than 0.5% to the global MRO market, a statistic that reflects the country’s peripheral role in this booming sector. It is no surprise that the reports do not account for India’s MRO scenario—it simply doesn’t matter when viewed from a global perspective. While the rest of the world capitalizes on this growing industry, Indian MRO remains stuck in bureaucratic debates and industry inputs which seem to go nowhere. Despite having a burgeoning aviation market, India continues to outsource its MRO needs to countries like Singapore, Turkey, the Netherlands, France, and Germany. Over 200,000 direct labor jobs, by one estimate, have been created in these countries solely to handle MRO work for Indian aviation. This raises a critical questions – Is India too wealthy to develop its own MRO sector, or are there deeper inefficiencies at play? Perhaps, as some suggest, the country is content to have foreign nations benefit from its aviation maintenance needs, either out of favor or sheer inertia. The scales, without a doubt, are tipped in favour of foreign MRO hubs, while Indian stakeholders continue to deliberate on trivial matters. There is a pervasive sense that by finally addressing the MRO sector’s issues and listening to industry input, the government risks “giving away the family jewels.” But the reality is far bleaker—those jewels are already firmly in the custody of foreign nations, with India left to collect the crumbs, all while believing it is making progress. Today, Indian MRO work represents less than 10% of the domestic market and a minuscule 0.5% of the global market. These numbers are a wake-up call to anyone paying attention, but it seems few are. India’s governance, it appears, is more interested in holding meetings, taking notes, and disregarding logic, all while self-congratulating and perpetuating the status quo. The question remains: is anyone in power truly listening, or is the MRO sector destined to remain an afterthought in India’s aviation ambitions?