Bangalore. 11 February 2019. MRO Association of India is exhibiting at the Skills Pavilion organised by MoD, MoCA, MSDE, NSDC and AASSC at Aero India 2019, February 20-24, 2019 at Yelanka Air Force Station at Hall F.

MRO Association, founded in 2011, is an industry body, engaging with Government bodies such as MoD, MoCA, MSDE, NSDC and AASSC in various aspects of aviation. It has also entered into an MoU with RGNAU.

MRO Association of India is a Govt recognized industry body. The association has actively participated in preparing the National Civil Aviation Policy (NCAP 2016).

Working with AASSC, the Association was instrumental in defining and validating 8 job roles in MRO Sector; two more job roles are in the pipeline.

Thakur Institute of Aviation Technology, Jawaharlal Aviation Institutes are Members of the Association. It also helps training institutes in securing OJT for students. The MRO business in India has the potential of creating 600,000 new jobs over the next decade.

With its growing aircraft fleet size, strategic geographic location, rich pool of engineering expertise and low labor cost, India has a huge potential to be the global Maintenance, Repair and Overhaul (MRO) hub given a long-time perspective.

The current market size of the MRO industry in India is assessed at about US$ 700-800 million which is expected to reach US$ 1.2 billion by 2020. India has the potential to become the third largest aviation market by 2022. India has long been viewed with interest from MROs globally seeking a valuable gateway between the Middle East and Asia-Pacific.

According to Aviation Week Fleet and MRO Forecast, the MRO market in India is expected to grow at 7.7% annually over the next decade, which is more than three times the global rate.

This demand is being driven by a fleet growing at 9.9% annually, from around 620 in FY 2018 to a projected fleet of over 2,300 in FY 2040. With over 1000 aircraft currently on order, India is likely to become the third largest buyer of commercial passenger planes in the world, only behind the US and China.

The growth is being boosted by the expansion and development of new airports, fast expanding LCCs, a liberal FDI policy, rising adoption of new technology and focus on regional connectivity etc.

Key challenges

Despite a rising fleet, Maintenance, Repair and Overhaul (MRO) industry continues to struggle for relevance. The biggest challenge is the severe tax anomaly with foreign jurisdictions. This is despite the widespread appreciation of the fact that, with a fast expanding fleet, India needs to build a robust domestic MRO eco-system. More so, given the government’s avowed commitment to push for ‘Make in India’.

Due to a limited MRO eco-system and a sub-optimal tax structure, most Indian carriers carry out MRO in Sri Lanka, South East Asia, Middle East or Europe. This entails additional cost of empty ferry flights, additional logistics costs and payment in foreign exchange. That it still works out cheaper and better than doing MRO in India does not show India in a great light.

There are about 40 overseas entities approved by DGCA to conduct MRO on India-registered aircraft. These account for over 90% of the MRO spend of Indian carriers.

Currently GST on aviation MRO is levied at 18%. In Singapore and Malaysia, tax is levied at 7% whereas in Sri Lanka there is none.

If there is a continued push for tax and procedural reforms, aircraft servicing in India can be 20-25 percent cheaper than its competing nations. It will help transform the moribund Indian MRO industry from mere line or base maintenance providers to value providers.

There is a possibility that aircraft OEMs and lessors may provide aircraft as a service, selling seat- hours instead of aircraft. MROs will then shift into being asset management platforms instead of simply fixing defects and performing planned checks. This may require a radical change in mindsets, capabilities and financial strength of Indian MROs.

KPMG has recently released a document Vision 2040 in cooperation with MoCA. Some key point are mentioned below:

Vision 2040

The Vision 2040 for MRO industry is as follows:

a. India shall be a global MRO hub, handling nearly 90% of the MRO requirements of Indian carriers.

b. At least 20% of the Indian MRO industry’s revenue shall come from foreign-registered aircraft.

c. Nearly 90% of redelivery maintenance shall be done within India.

Key steps to achieve Vision 2040

1. MRO taskforce

A high-power task force for promotion of MRO needs to be formed under the leadership of a Joint Secretary of MoCA. The task force may have members from relevant ministries and regulators. It should also have five representatives from the airlines, OEMs and MRO providers. The task force may analyse the various options and action steps required to make India a global MRO hub; develop a clear roadmap; and report actions and outcomes to the aviation minister.

2. Tax disparity

MROs and component warehouses need to be declared as free trade zones with zero- rate of GST and a ten-year holiday on corporate tax, capital gains tax and dividend distribution tax. There is no loss of indirect tax revenue since the GST will be recovered from the end consumer – the airlines. There will be no loss of direct tax revenue since the MRO industry is almost non-existent today.

Disrupting existing relationships between Indian carriers and foreign MROs is not easy. The MRO task force may consider additional incentives like capital subsidy and interest subsidies to attract investments.

In order to build an MRO ecosystem in high-tech systems like engines and avionics, there could be additional incentives provided for MROs investing in these categories.

3. Import restriction

The government may consider restricting airlines from taking Indian aircraft abroad for repairs, except in cases where the infrastructure and technical knowhow is not available in India. Such a restriction may be applied five years after the tax anomalies are removed, giving ample time to develop the MRO eco-system in India.

4. Alternate locations

MRO eco-system needs to be established near large airports. Many busy airports like Mumbai are already congested. This creates an opportunity for progressive state governments to create an incentive package over and above the central package and attract large OEMs or MRO providers to their state.

5. Airport royalties

In line with Clause 18B (f) of NCAP 2016, MoCA may issue a notification abolishing, with immediate effect, all royalties and charges (other than reasonable lease rentals) levied by airport operators on MROs for a period of five years.

6. Illustrated Parts Catalogues

Components, tools, test benches and consumables related to MRO should be subject to immediate clearance by Customs without any harassment and delays. The Illustrated Parts Catalogues (IPC) issued by OEMs should be treated as adequate proof of the genuineness of the aircraft component. Any violation by an MRO may invite cancellation of license and appropriate penalties to serve as a deterrent.

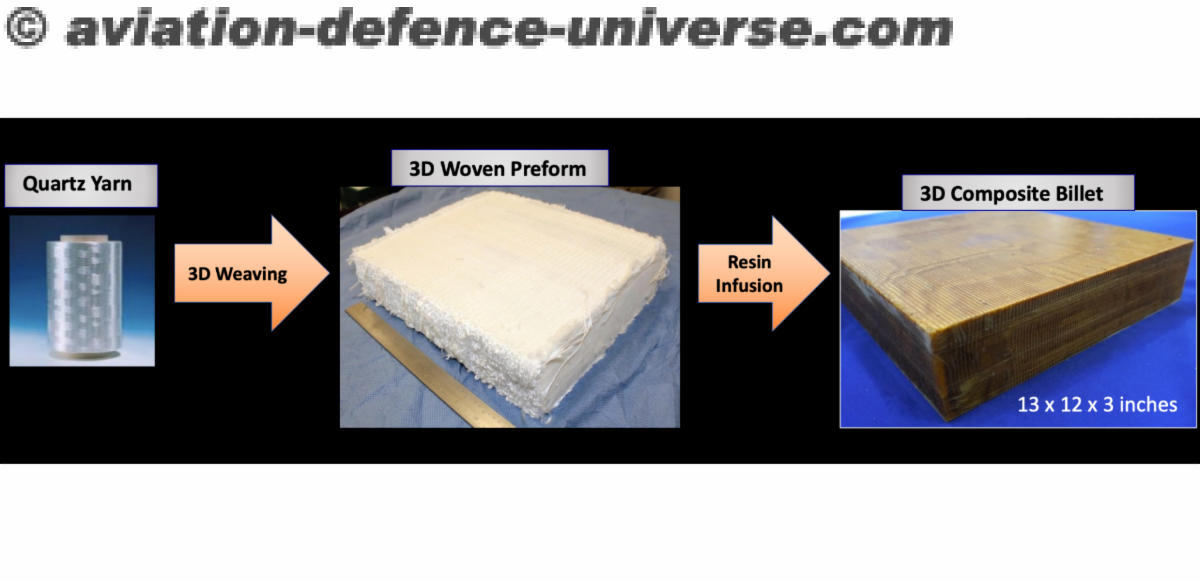

7. Skill-building

The MRO facilities will require ancillary industries and services. These include repair and testing facilities for avionics, electrical equipment, hydro-mechanical and pneumatic components, composite structures and aircraft interiors etc. There will a large requirement for super-specialised training facilities. This shall need to be captured in the incentive package in close coordination with the Aerospace and Aviation Sector Skill Council (AASSC).