30 July 2024 (Geneva) – The International Air Transport Association (IATA) released data for June 2024 global air cargo markets showing continuing strong annual growth in demand. This contributed to an exceptional first half-year performance for air cargo, with volumes exceeding 2023, 2022, and even the record-breaking 2021 levels.

30 July 2024 (Geneva) – The International Air Transport Association (IATA) released data for June 2024 global air cargo markets showing continuing strong annual growth in demand. This contributed to an exceptional first half-year performance for air cargo, with volumes exceeding 2023, 2022, and even the record-breaking 2021 levels.

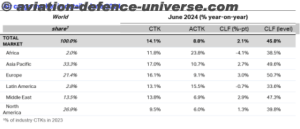

- Total demand, measured in cargo tonne-kilometers (CTKs*), rose by 14.1% compared to June 2023 levels (15.6% for international operations). This is the seventh consecutive month of double-digit year-on-year growth.

- Capacity, measured in available cargo tonne-kilometers (ACTKs), increased by 8.8% compared to June 2023 (10.8% for international operations).

- Total half-year (H1) demand increased by 13.4% compared to H1 2023, by 4.3% compared to H1 2022, and by 0.02% compared to H1 2021.

“Air cargo demand surged in June. Strong growth across all regions and major trade lanes combined for a record-breaking first-half performance in terms of CTKs. Maritime shipping constraints and a booming e-commerce sector are among the strongest growth drivers. Meanwhile, the sector has remained largely impervious to ongoing political and economic challenges, and the US customs crackdown on e-commerce deliveries from China. Air cargo looks to be on solid ground to continue its strong performance into the second half of 2024,” said Willie Walsh, IATA’s Director General.

Several factors in the operating environment should be noted:

- In June the Purchasing Managers Index (PMI) for global manufacturing output indicated expansion (52.3) while the new export orders PMI registered a small contraction, falling below the critical 50-point benchmark to 49.3.

- Global cross-border trade expanded 0.1% month-on-month in May while industrial production stayed level compared to the previous month.

- Inflation was a mixed picture in June. In the EU and Japan, inflation rates stayed roughly constant compared to the previous month at 2.6% and 2.8% respectively, while dropping in the US to 3.0%. In contrast, China’s inflation rate remained near zero (0.3%) reflecting weak domestic demand amid high unemployment, slow income growth, and a crisis in the real estate sector, a trend that has persisted since 2023.

June Regional Performance

Asia-Pacific airlines saw 17.0% year-on-year demand growth for air cargo in June — the strongest among all regions. Demand on the Africa-Asia trade lane grew by 37.5% year-on-year, while the Europe-Asia, Within Asia and Middle East-Asia trade lanes rose by 20.3%, 21.0% and 15.1% respectively. Capacity increased by 10.7% year-on-year.

North American carriers saw 9.5% year-on-year demand growth for air cargo in June — the weakest among all regions. Demand on the North America-Europe route saw an increase of 6.7%, while the Asia-North America trade lane, the world’s largest, grew by 12.8% year-on-year, the largest annual increase in five months. June capacity increased by 6.0% year-on-year.

European carriers saw 16.1% year-on-year demand growth for air cargo in June. Intra-European air cargo rose by 16.7% compared to June 2023, the sixth month in a row of double-digit annual growth. Europe–Middle East and Europe–Asia routes saw demand increase by 30.2% and 20.3% respectively. June capacity increased 9.1% year-on-year.

Middle Eastern carriers saw 13.8% year-on-year demand growth for air cargo in June. As mentioned above, the Middle East–Europe market performed particularly well with 30.2% annual growth, ahead of Middle East–Asia which grew by 15.1% year-on-year. June capacity increased 6.9% year-on-year.

Latin American carriers saw 13.1% year-on-year demand growth for air cargo in June. Capacity increased 15.5% year-on-year. Notably, Latin America posted the second-highest increase in international demand growth at 17.2% in June, up 6.3 percentage points compared to the previous month.

African airlines saw 11.8% year-on-year demand growth for air cargo in June. Demand on the Africa–Asia market increased by 37.5% compared to June 2023, the strongest performance of all trade lanes. June capacity increased by 23.8% year-on-year.