Third quarter 2024:

- Total orders of $12.6B, +28%

- Total revenue (GAAP) of $9.8B, +6%; adjusted revenue* $8.9B, +6%

- Profit (GAAP) of $1.9B, Favorable; operating profit* $1.8B, +14%

- Profit margin (GAAP) of 19.2%, +1,560 bps; operating profit margin* 20.3%, +150 bps • Continuing EPS (GAAP) of $1.56, Favorable; adjusted EPS* $1.15, +25%

- Cash from Operating Activities (GAAP) of $1.9B, +7%; free cash flow* $1.8B, +5%

EVENDALE, Ohio — October 22, 2024 — GE Aerospace (NYSE:GE) announced results today for the third quarter ending September 30, 2024.

GE Aerospace Chairman and CEO H. Lawrence Culp, Jr. said, “The GE Aerospace team delivered strong results, with demand driving orders up 28%. We grew earnings 25% and produced substantial free cash flow, both largely driven by services. Given the strength of our results and 4Q expectations, we’re raising our earnings and cash guidance for the year.”

Culp continued, “Leveraging FLIGHT DECK we’re focused on servicing and delivering our engines faster without compromising safety and quality. While there’s more work to do, we made meaningful progress with engine deliveries improving more than 20% sequentially while also expanding aftermarket capacity. Our path forward is clear, and I am confident GE Aerospace is positioned to deliver a solid year in our first year as a standalone company.”

GE Aerospace’s key highlights included:

- Continued to execute our action plan using FLIGHT DECK to address supply chain constraints at our top 15 supplier sites, leading to material output from a subset of priority supplier sites increasing sequentially.

- Grew LEAP internal shop visits more than 20% year-over-year, and continued to expand capacity to support aftermarket growth by adding a dedicated LEAP MRO shop in Poland to our internal network.

- Secured narrowbody wins as Avolon ordered 150 LEAP-1A engines to power 75 A320 aircraft and announced widebody commitments from EVA Air for GEnx engines to power four 787s and Qatar Airways for 40 GE9X engines to power 20 777s.

- Finalized a commitment with the Polish Ministry of National Defense for over 200 of our T700 engines to power their anticipated acquisition of 96 Boeing Apache Guardian helicopters and was selected to overhaul and upgrade the GEnx-2B engines powering the United States Air Force Survivable Airborne Operations Center (SAOC)Boeing 747-8.

- Announced plans to conduct early dust ingestion tests of the Open Fan design at the core of our CFM RISE technology initiative, the earliest plan for such tests reflecting the lessons learned from other engines that operate at higher temperature environments.

- Progressed testing of the T901 engine on the Blackhawk test aircraft at Sikorsky to advance towards the next milestone of power-on and ground-runs while our Digital Backbone for Bell’s Future Long Range Assault Aircraft was a critical part of the United States Army passing Milestone B and entering the next phase of development.

- Continued to execute the company’s capital allocation priorities with $4.4 billion returned to shareholders year-to-date, including in 3Q repurchasing 7.9 million common shares for $1.3 billion under the company’s $15 billion share repurchase program announced in March 2024 and selling 17.3 million shares of GE HealthCare for $1.5 billion in proceeds.

Total Company Results

Three Months Ended September 30 Nine months ended September 30 Dollars in millions; per-share amounts in dollars, diluted 2024 2023 Year

GAAP Metrics

Total Revenue $9,842 $9,302 6 % $27,890 $25,893 8 % Profit Margin 19.2 % 3.6 % 1,560 bps 19.1 % 33.9 % (1,480) bps Continuing EPS 1.56 0.20 F 4.34 7.25 (40) % Cash from Operating Activities (CFOA) 1,913 1,790 7 % 4,499 3,354 34 %

Non-GAAP Metrics

Adjusted Revenue $8,943 $8,461 6 % $25,241 $23,412 8 % Operating Profit-a) 1,818 1,594 14 % 5,265 4,226 25 % Operating Profit Margin-a) 20.3 % 18.8 % 150 bps 20.9 % 18.1 % 280 bps Adjusted EPS-b) 1.15 0.92 25 % 3.28 2.30 43 % Free Cash Flow (FCF)-c) 1,805 1,716 5 % 4,572 3,487 31 %

(a) Excludes Insurance, interest and other financial charges, U.S tax equity, non-operating benefit cost (income), gains (losses) on retained and sold ownership interests and other equity securities, gains (losses) on purchases and sales of business interests, restructuring & other charges and other items

(b) Excludes Insurance, non-operating benefit cost (income), U.S tax equity, gains (losses) on retained and sold ownership interests and other equity securities, gains (losses) on purchases and sales of business interests, restructuring & other charges and other items (c- Includes gross additions to PP&E and internal-use software. Excludes separation cash expenditures and Corporate & Other restructuring cash expenditures.

Also in the quarter:

- Continued efforts to exit non-core assets, including completing the sale of our licensing business to Dolby Laboratories, recording a pre-tax gain on sale of $341 million.

- Performed an interim impairment test at our Colibrium Additive reporting unit given declines in the additive manufacturing industry due to slower adoption of the technology, which resulted in a non-cash loss of $251 million in Goodwill. Colibrium Additive is a critical business for current and future technology at GE Aerospace and we continue to focus on where it can create the most value.

- Recorded a pre-tax charge of $328 million in connection with reaching an agreement in principle to settle a legacy shareholder lawsuit.

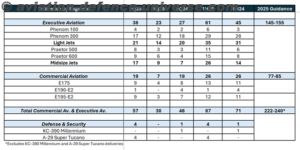

GE Aerospace Full Year 2024 Guidance

Based on GE Aerospace’s strong year-to-date performance and trajectory entering the fourth quarter, the company is updating its full-year 2024 and business specific guidance and now expects:

2023 July 2024 Guide October 2024 Guide

Adjusted Revenue* Growth Adjusted Revenue*

Operating Profit*

Operating profit margin*

+22%

$32.0B HSD HSD

$5.6B

17.4% $6.5B-$6.8B $6.7-$6.9B

Adjusted EPS* $2.95 $3.95-$4.20 $4.20-$4.35

FCF* conversion-a)$4.7B

Free Cash Flow*

~145%

$5.3B-$5.6B >100%

$5.6B-$5.8B >100%

- Commercial Engines & Services: Continue to expect revenue growth of low-double-digits to mid-teens. Increasing operating profit to a range of $6.6-$6.8 billion, up from our prior guidance in July of $6.3-$6.5 billion

- Defense & Propulsion Technologies: Continue to expect revenue growth of mid-single-digits to high-single digits and expect operating profit to be at the lower end of the current $1.0-$1.3 billion range

Results by Reporting Segment

The following discussions and variance explanations are intended to reflect management’s view of the relevant comparisons of financial results.

Commercial Engines & Services

Three months ended September 30 Nine months ended September 30

(Dollars in millions) 2024 2023 Year on Year 2024 2023 Year on Year Orders $9,799 $7,603 29 % $27,266 $20,450 33 % Revenues 7,003 6,457 8 % 19,231 17,426 10 % Segment Profit/(Loss) 1,799 1,545 16 % 4,897 4,148 18 % Segment Profit/(Loss) Margin 25.7 % 23.9 % 180 bps 25.5 % 23.8 % 170 bps

Orders of $9.8 billion increased 29%, with both services and equipment up more than 20%. Revenue of $7.0 billion was up 8% with services growing 10% from higher spare parts sales, increasing shop visit workscopes and improved pricing. Equipment revenue was up 5%, with customer mix and price more than offsetting lower units. Profit of $1.8 billion was up 16%, with margins expanding 180 basis points, from higher services volume and price, which offset inflation and investments.

Defense & Propulsion Technologies

Three months ended September 30 Nine months ended September 30

(Dollars in millions) 2024 2023 Year on Year 2024 2023 Year on Year Orders $3,044 $2,548 19 % $8,408 $7,905 6 % Revenues 2,243 2,205 2 % 6,955 6,546 6 % Segment Profit/(Loss) 220 269 (18) % 820 671 22 % Segment Profit/(Loss) Margin 9.8 % 12.2 % (240) bps 11.8 % 10.3 % 150 bps

Orders of $3.0 billion were up 19%, primarily from strong demand in Defense & Systems. Revenue of $2.2 billion grew 2%, driven by Propulsion & Additive Technologies, which was up 9% primarily driven by Avio Aero. This was partially offset by Defense & Systems revenue, which was down (2)% due to lower engine units and unfavorable

engine mix, which more than offset price. Profit of $220 million, was down (18)% year-over-year, with margins down (240) basis points, driven by inflation, engine mix, and investments, which more than offset price improvement.

Financial Measures That Supplement GAAP

We believe that presenting non-GAAP financial measures provides management and investors useful measures to evaluate performance and trends of the total company and its businesses. This includes adjustments in recent periods to GAAP financial measures to increase period-to-period comparability following actions to strengthen our overall financial position and how we manage our business.

In addition, management recognizes that certain non-GAAP terms may be interpreted differently by other companies under different circumstances. In various sections of this report we have made reference to the following non-GAAP financial measures in describing our (1) revenues, specifically Adjusted revenues, (2) profit, specifically Operating profit and Operating profit margin; Adjusted earnings (loss) and Adjusted earnings (loss) per share (EPS), (3) cash flows, specifically free cash flows (FCF), and (4) guidance, specifically 2024 Operating profit, 2024 Adjusted EPS and 2024 FCF.

The reasons we use these non-GAAP financial measures and the reconciliations to their most directly comparable GAAP financial measures follow. Certain columns, rows or percentages within these reconciliations may not add or recalculate due to the use of rounded numbers. Totals and percentages presented are calculated from the underlying numbers in millions.

OPERATING PROFIT AND PROFIT MARGIN (NON-GAAP) Three months ended September 30 Nine months ended September 30 (Dollars in millions) 2024 2023 V% 2024 2023 V% Total revenues (GAAP) $ 9,842 $ 9,302 6 % $ 27,890 $ 25,893 8 %

Less: Insurance revenues 899 842 2,649 2,480 Adjusted revenues (Non-GAAP) $ 8,943 $ 8,461 6 % $ 25,241 $ 23,412 8 % Total costs and expenses (GAAP) $ 8,970 $ 8,124 10 % $ 24,529 $ 22,883 7 %

Less: Insurance cost and expenses 728 742 2,108 2,248 Less: U.S. tax equity cost and expenses 5 — 9 — Less: interest and other financial charges 251 270 762 767 Less: non-operating benefit cost (income) (207) (244) (628) (731)

Less: restructuring & other 378 44 525 130 Less: goodwill impairments 251 — 251 — Less: separation costs 74 147 408 474 Add: noncontrolling interests (10) 1 (5) 7

Adjusted costs (Non-GAAP) $ 7,481 $ 7,166 4 % $ 21,089 $ 20,003 5 % Other income (loss) (GAAP) $ 1,021 $ (845) F $ 1,965 $ 5,755 (66) % Less: U.S. tax equity (48) (34) (121) (108)

Less: gains (losses) on retained and sold ownership interests and other equity securities 357 (1,110) 598 5,155

Less: gains (losses) on purchases and sales of business

interests 356 — 375 (108) Adjusted other income (loss) (Non-GAAP) $ 356 $ 299 19 % $ 1,112 $ 817 36 % Profit (loss) (GAAP) $ 1,893 $ 333 F $ 5,327 $ 8,765 (39) % Profit (loss) margin (GAAP) 19.2 % 3.6 % 1,560 bps 19.1 % 33.9 % (1,480) bps

Operating profit (loss) (Non-GAAP) $ 1,818 $ 1,594 14 % $ 5,265 $ 4,226 25 % Operating profit (loss) margin (Non-GAAP) 20.3 % 18.8 % 150 bps 20.9 % 18.1 % 280 bps

We believe that adjusting profit to exclude the effects of items that are not closely associated with ongoing operations provides management and investors with a meaningful measure that increases the period-to-period comparability. Gains (losses) and restructuring and other items are impacted by the timing and magnitude of gains associated with dispositions, and the timing and magnitude of costs associated with restructuring and other activities. We also use Operating profit* as a performance metric at the company level for our annual executive incentive plan for 2024.

ADJUSTED EARNINGS (LOSS) (NON-GAAP) Three months ended September 30 Nine months ended September 30 (In millions, Per-share amounts in dollars) 2024 2023 2024 2023 Earnings EPS Earnings EPS Earnings EPS Earnings EPS

Earnings (loss) from continuing operations (GAAP) $ 1,705 $ 1.56 $ 215 $ 0.20 $ 4,766 $ 4.34 $ 7,966 $ 7.25 Insurance earnings (loss) (pre-tax) 172 0.16 100 0.09 543 0.49 235 0.21 Tax effect on Insurance earnings (loss) (37) (0.03) (23) (0.02) (116) (0.11) (54) (0.05)

Less: Insurance earnings (loss) (net of tax) 135 0.12 77 0.07 427 0.39 181 0.17 U.S. tax equity earnings (loss) (pre-tax) (59) (0.05) (47) (0.04) (154) (0.14) (143) (0.13) Tax effect on U.S. tax equity earnings (loss) 70 0.06 54 0.05 189 0.17 173 0.16

Less: U.S. tax equity earnings (loss) (net of tax) 11 0.01 8 0.01 35 0.03 31 0.03 Non-operating benefit (cost) income (pre-tax) (GAAP) 207 0.19 244 0.22 628 0.57 731 0.67 Tax effect on non-operating benefit (cost) income (43) (0.04) (51) (0.05) (132) (0.12) (154) (0.14)

Less: Non-operating benefit (cost) income (net of tax) 164 0.15 193 0.18 496 0.45 578 0.53

Gains (losses) on purchases and sales of business interests (pre-tax) 356 0.33 — — 375 0.34 (108) (0.10)

Tax effect on gains (losses) on purchases and sales of business interests (10) (0.01) (6) (0.01) (5) — (3) —

Less: Gains (losses) on purchases and sales of business interests (net of tax) 346 0.32 (6) (0.01) 371 0.34 (111) (0.10)

Gains (losses) on retained and sold ownership interests and other equity securities (pre-tax) 357 0.33 (1,110) (1.01) 598 0.54 5,155 4.69

Tax effect on gains (losses) on retained and sold ownership interests and other equity securities(a)(b) — — — — (1) — — —

Less: Gains (losses) on retained and sold ownership interests and other equity securities (net of tax) 357 0.33 (1,110) (1.01) 597 0.54 5,155 4.69 Restructuring & other (pre-tax) (378) (0.35) (44) (0.04) (525) (0.48) (130) (0.12) Tax effect on restructuring & other 79 0.07 9 0.01 110 0.10 27 0.02

Less: Restructuring & other (net of tax) (298) (0.27) (35) (0.03) (415) (0.38) (103) (0.09) Goodwill impairments (pre-tax) (251) (0.23) — — (251) (0.23) — — Tax effect on goodwill impairments — — — — — — — —

Less: goodwill impairments (net of tax) (251) (0.23) — — (251) (0.23) — — Separation costs (pre-tax) (74) (0.07) (147) (0.13) (408) (0.37) (474) (0.43) Tax effect on separation costs 61 0.06 247 0.22 311 0.28 244 0.22

Less: Separation costs (net of tax) (13) (0.01) 100 0.09 (97) (0.09) (230) (0.21)

Less: Excise tax and accretion of preferred share redemption — — (28) (0.03) — — (58) (0.05) Adjusted earnings (loss) (Non-GAAP) $ 1,255 $ 1.15 $ 1,016 $ 0.92 $ 3,602 $ 3.28 $ 2,523 $ 2.30 (a) Includes tax benefits available to offset the tax on gains (losses) on equity securities.

(b) Includes related tax valuation allowances.

Earnings-per-share amounts are computed independently. As a result, the sum of per-share amounts may not equal the total. The service cost for our pension and other benefit plans are included in Adjusted earnings*, which represents the ongoing cost of providing pension benefits to our employees. The components of non-operating benefit costs are mainly driven by capital allocation decisions and market performance. We believe the retained cost in Adjusted earnings* provides management and investors a useful measure to evaluate the performance of the total company and increases period-to-period comparability. We also use Adjusted EPS* as a performance metric at the company level for our performance stock units granted in 2024.

FREE CASH FLOWS (FCF) (NON-GAAP) Three months ended September 30 Nine months ended September 30 (In millions) 2024 2023 V% 2024 2023 V% Cash flows from operating activities (CFOA) (GAAP) $ 1,913 $ 1,790 7 % $ 4,499 $ 3,354 34 %

Add: gross additions to property, plant and equipment and internal-use software (266) (222) (765) (612) Less: separation cash expenditures (144) (127) (716) (617) Less: Corporate & Other restructuring cash expenditures (14) (21) (123) (128)

Free cash flows (FCF) (Non-GAAP) $ 1,805 $ 1,716 5 % $ 4,572 $ 3,487 31 %

We believe investors may find it useful to compare free cash flows* performance without the effects of separation cash expenditures and Corporate & Other restructuring cash expenditures (associated with the separation-related program announced in the fourth quarter of 2022). We believe this measure will better allow management and investors to evaluate the capacity of our operations to generate free cash flows. We also use FCF* as a performance metric at the company level for our annual executive incentive plan and performance stock units granted in 2024.

2024 GUIDANCE: 2024 OPERATING PROFIT (NON-GAAP)

We cannot provide a reconciliation of the differences between the non-GAAP expectations and corresponding GAAP measure for Operating profit* in 2024 without unreasonable effort due to the uncertainty of timing of any gains or losses related to acquisitions & dispositions, the timing and magnitude of the financial impact related to the mark-to-market of our remaining investment in GE HealthCare and the timing and magnitude of restructuring expenses. Although we have attempted to estimate the amount of gains and restructuring charges for the purpose of explaining the probable significance of these components, this calculation involves a number of unknown variables, resulting in a GAAP range that we believe is too large and variable to be meaningful.

2024 GUIDANCE: 2024 ADJUSTED EPS (NON-GAAP)

We cannot provide a reconciliation of the differences between the non-GAAP expectations and corresponding GAAP measure for Adjusted EPS* in 2024 without unreasonable effort due to the uncertainty of timing of any gains or losses related to acquisitions & dispositions, the timing and magnitude of the financial impact related to the mark-to-market of our remaining investment in GE HealthCare and the timing and magnitude of restructuring expenses. Although we have attempted to estimate the amount of gains and restructuring charges for the purpose of explaining the probable significance of these components, this calculation involves a number of unknown variables, resulting in a GAAP range that we believe is too large and variable to be meaningful.

2024 GUIDANCE: 2024 FCF (NON-GAAP)

We cannot provide a reconciliation of the differences between the non-GAAP expectations and corresponding GAAP measure for free cash flows* in 2024 without unreasonable effort due to the uncertainty of timing for separation and restructuring related cash expenditures.

Caution Concerning Forward Looking Statements:

This release and certain of our public communications and SEC filings may contain statements related to future, not past, events. These forward-looking statements often address our expected future business and financial performance and financial condition, and often contain words such as “expect,” “anticipate,” “intend,” “plan,” “believe,” “seek,” “see,” “will,” “would,” “estimate,” “forecast,” “target,” “preliminary,” or “range.” Forward-looking statements by their nature address matters that are, to different degrees, uncertain, such as statements about the impacts of macroeconomic and market conditions and volatility on our business operations, financial results and financial position; conditions affecting the aerospace and defense industry, including our customers and suppliers; our expected financial performance, including cash flows, revenues, margins, earnings and earnings per share; planned and potential transactions; our credit ratings and outlooks; our funding and liquidity; our businesses’ cost structures and plans to reduce costs; restructuring, impairment or other financial charges; or tax rates.

For us, particular areas where risks or uncertainties could cause our actual results to be materially different than those expressed in our forward-looking statements include:

- changes in macroeconomic and market conditions and market volatility (including risks related to recession, inflation, supply chain constraints or disruptions, interest rates, values of securities and other financial assets, oil, jet fuel and other commodity prices and exchange rates), and the impact of such changes and volatility on our business operations and financial results;

- global economic trends, competition and geopolitical risks, including impacts from the ongoing conflict between Russia and Ukraine and related sanctions and risks related to conflict in the Middle East; demand or supply shocks from events such as a major terrorist attack, war, natural disasters or actual or threatened public health pandemics or other emergencies; or an escalation of sanctions, tariffs or other trade tensions between the U.S. and China or other countries;

- market or other developments that may affect demand or the financial strength and performance of airframers, airlines, suppliers and other key aerospace and defense industry participants, such as demand for air travel, supply chain or other production constraints, shifts in U.S. or foreign government defense programs and other industry dynamics;

- pricing, cost, volume and the timing of sales, investment and production by us and our customers, suppliers or other industry participants;

- the impact of actual or potential safety or quality issues or failures of our products or third-party products with which our products are integrated, including design, production, performance, durability or other issues, and related costs and reputational effects;

- operational execution, including our performance amidst market growth and ramping newer product platforms, meeting delivery and other contractual obligations, improving turnaround times in our services businesses and reducing costs over time;

- the amount and timing of our earnings and cash flows, which may be impacted by macroeconomic, customer, supplier, competitive, contractual, financial or accounting (including changes in estimates) and other dynamics and conditions;

- our capital allocation plans, including the timing and amount of dividends, share repurchases, acquisitions, organic investments and other priorities;

- our decisions about investments in research and development or new products, services and platforms, and our ability to launch new products in a cost-effective manner, as well as technology developments and other dynamics that could shift the demand or competitive landscape for our products and services;

- our success in executing planned and potential transactions, including the timing for such transactions, the ability to satisfy any applicable pre-conditions and the expected benefits;

- downgrades of our credit ratings or ratings outlooks, or changes in rating application or methodology, and the related impact on our funding profile, costs, liquidity and competitive position;

- capital or liquidity needs associated with our run-off insurance operations and mortgage portfolio in Poland (Bank BPH), the amount and timing of any required future capital contributions and any strategic options that we may consider;

- changes in law, regulation or policy that may affect our businesses, such as trade policy and tariffs; government defense budgets; regulation, incentives and emissions offsetting or trading regimes related to climate change; and the effects of tax law changes;

- the impact of regulation; government investigations; regulatory, commercial and legal proceedings or disputes; environmental, health and safety matters; or other legal compliance risks, including the impact of shareholder and related lawsuits, Bank BPH and other proceedings that are described in our SEC filings;

- the impact related to information technology, cybersecurity or data security breaches at GE Aerospace or third parties; and

- the other factors that are described in the “Risk Factors” section in our Quarterly Report on Form 10-Q for the quarter ended March 31, 2024, as such descriptions may be updated or amended in any future reports we file with the SEC.

These or other uncertainties may cause our actual future results to be materially different than those expressed in our forward-looking statements. We do not undertake to update our forward-looking statements. This document includes certain forward-looking projected financial information that is based on current estimates and forecasts. Actual results could differ materially.

Additional Information

CFM International is a 50/50 JV that produces CFM56 and LEAP engine families. RISE is a program of CFM International. CFM RISE is a registered trademark. Engine Alliance is a 50/50 JV that produces the GP7200 engine.

GE Aerospace’s Investor Relations website at www.geaerospace.com/investor-relations, as well as GE Aerospace’s LinkedIn and other social media accounts, contain a significant amount of information about GE Aerospace, including financial and other information for investors. GE Aerospace encourages investors to visit these websites from time to time, as information is updated and new information is posted.

Additional financial information can be found on the Company’s website at: www.geaerospace.com/investor relations under Events and Reports.

Conference Call and Webcast

GE Aerospace will discuss its results during its investor conference call today starting at 7:30 a.m. ET. The conference call will be broadcast live via webcast, and the webcast and accompanying slide presentation containing financial information can be accessed by visiting the Events and Reports page on GE Aerospace’s website at: www.geaerospace.com/investor-relations. An archived version of the webcast will be available on the website after the call.