- FY22 Order Inflow grew by 10%, with a stellar growth of 46% recorded for Q4

- FY22 Revenue grew by 15%

- FY22 Recurring PAT registered growth of 23%

- Board recommends a final dividend of ₹ 22 per share

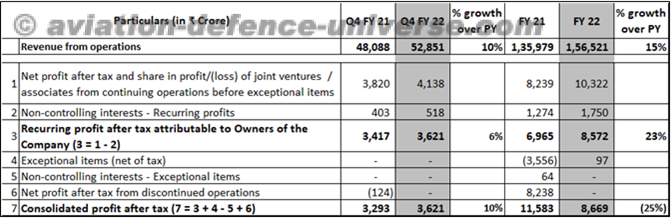

Mumbai, May 12, 2022. Larsen & Toubro achieved Consolidated Revenues of ₹ 156,521 crore for the year ended March 31, 2022 recording a y-o-y growth of 15% with strong execution in project business aided by continuing growth momentum in the IT&TS portfolio. International revenues during the year at ₹ 55,783 crore constitute 36% of the total.

For the quarter ended March 31, 2022, the Consolidated Revenues at ₹ 52,851 crore registered a y-o-y growth of 10%. International sales during the quarter at ₹ 17,550 crore constituted 33% of the total revenue.

For the year ended March 31, 2022, the Consolidated Net Profit After Tax (excluding exceptional items and discontinued operations) at ₹ 8,572 crore registered a robust growth of 23% over the previous year. The Consolidated Net Profit After Tax (including exceptional items and discontinued operations) for the year ended March 31, 2022 was ₹ 8,669 crore.

The Consolidated Net Profit After Tax for the quarter ended March 31, 2022 at ₹ 3,621 crore, registered a growth of 10% over the corresponding quarter of the previous year, in line with revenue growth.

The Board of Directors has recommended a final dividend of ₹ 22 per equity share for the approval of shareholders, an increase of 22% per share over previous year.

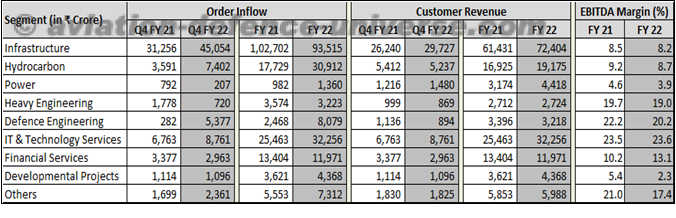

The Company secured orders worth ₹ 192,997 crore at the group level during the year ended March 31, 2022, registering a growth of 10% over previous year. During the year, major traction was seen in the international region, especially from the Middle East, where the

Company bagged large value orders during the year, taking the share of international orders to 44% of the total order inflow, as compared to 27% in the previous year.

The Company bagged orders worth ₹ 73,941 crore during the quarter ended March 31, 2022, registering a strong growth of 46% over the corresponding quarter of the previous year, with the Infrastructure segment booking a mega order from the Middle East. The International orders at ₹ 32,241 crore during the quarter comprised 44% of the total order inflow.

The consolidated order book of the group was at record levels, at ₹ 357,595 crore as on March 31, 2022, with international orders having a share of 27%.

Infrastructure Segment

The Infrastructure segment secured order inflow of ₹ 93,515 crore, during the year ended March 31, 2022, registering a de-growth of 9% compared to previous year which had receipt of the large value Mumbai – Ahmedabad High-Speed Rail orders. International orders at

₹ 27,231 crore constituted 29% of the total order inflow of the segment during the year.

The segment secured orders of ₹ 45,054 crore, during the quarter ended March 31, 2022, registering growth of 44% over the corresponding quarter of the previous year, with various orders secured across sub segments. International orders constituted 46% of the total order inflow for the quarter.

The segment order book stood at ₹ 260,624 crore as on March 31, 2022, with the share of international orders at 22%.

For the year ended March 31, 2022, the customer revenue at ₹ 72,404 crore registered a y-o-y growth of 18%, with a good pick up in execution momentum of the large value orders in the portfolio. International revenue constituted 23% of the total customer revenue of the segment during the year.

The segment recorded customer revenues of ₹ 29,727 crore for the quarter ended March 31, 2022, registering y-o-y growth of 13%. International revenues constituted 25% of the total customer revenues of the segment during the quarter.

The EBITDA margin of the segment during the year ended March 31, 2022 was at 8.2% vis-à-vis 8.5% recorded in the previous year. The drop in margin is primarily due to unreasonably high commodity prices.

Hydrocarbon Segment

The Hydrocarbon Segment secured orders valued at ₹ 30,912 crore during the year ended March 31, 2022, registering a strong growth of 74% compared to previous year, with receipt of mega orders from Middle East, both in the Offshore and Onshore verticals. International order inflow constituted 79% of the total order inflow of the segment.

The segment secured orders valued at ₹ 7,402 crore during the quarter ended March 31, 2022, registering substantial growth over the corresponding quarter of the previous year with receipt of a large value order in the Offshore vertical. International orders constituted 35% of the total order inflow.

The segment order book was at ₹ 56,398 crore as on March 31, 2022, with the international

order book constituting 60%.

For the year ended March 31, 2022, the customer revenues at ₹ 19,175 crore registered y-o-y growth of 13% with the Onshore portfolio in the order book gaining execution momentum. International revenue constituted 36% of the total customer revenue of the segment for the year ended March 31, 2022.

The segment posted customer revenues of ₹ 5,237 crore during the quarter ended March 31, 2022, recording a marginal decline of 3% y-o-y. International revenues had a share of 31% of the total customer revenues for the quarter.

The EBITDA margin of the segment at 8.7% for the year ended March 31, 2022 declined compared to 9.2% over previous year, reflecting input cost inflation and change in the composition of jobs amongst the sub-segments.

During the quarter, L&T Hydrocarbon Engineering Limited was merged with Parent entity with appointed date April 01, 2021.

Power Segment

The Power segment for the year ended March 31, 2022, secured orders of ₹ 1,360 crore registering a growth of 39% compared to previous year. The business opportunities in the segment is subdued, considering ESG concerns on fossil fuel fired power generation, thereby resulting in drop in investment / tendering activity. International orders constituted 9% of the total order inflow of the segment during the year.

The segment registered order inflow of ₹ 207 crore for the quarter ended March 31, 2022.

The order book of the segment was at ₹ 8,901 crore as on March 31, 2022, with the share of international orders at 6%.

For the year ended March 31, 2022, the customer revenues at ₹ 4,418 crore, registered a y-o-y growth of 39% with execution impetus in major projects in the opening order book. International revenues constituted 6% of the total customer revenues of the segment during the year.

The segment recorded customer revenues of ₹ 1,480 crore for the quarter ended March 31, 2022, recording a growth of 22% over the corresponding quarter of the previous year.

The segment EBITDA margin for the year ended March 31, 2022 was at 3.9%, lower compared to 4.6% in the previous year, due to mix of jobs under execution.

Heavy Engineering Segment

The Heavy Engineering segment secured orders valued at ₹ 3,223 crore during the year ended March 31, 2022 registering decline of 10% y-o-y due to deferral of targeted prospects. Export orders constituted 51% of the total order inflow of the segment during the year.

The segment recorded an order inflow of ₹ 720 crore during the quarter ended March 31, 2022, recording a decline of 60% compared to corresponding quarter of the previous year, which had a large value domestic order. Export orders constituted 47% of the total order inflow.

The order book of the segment was at ₹ 4,714 crore as on March 31, 2022, with the share of export orders at 39%.

For the year ended March 31, 2022, customer revenues at ₹ 2,724 crore, remained flat over previous year as new orders in the portfolio are still in the early stage of execution. Export sales constituted 40% of the total customer revenue of the segment.

The segment posted customer revenues of ₹ 869 crore for the quarter ended March 31, 2022, recording a y-o-y decline of 13%. Export sales comprised 24% of the total customer revenues for the quarter.

The EBITDA margin of the segment at 19.0% for the year ended March 31, 2022 declined compared to 19.7% reported in the previous year, the drop is primarily due to lower export incentives.

Defence Engineering Segment

The Defence Engineering segment secured orders valued at ₹ 8,079 crore during the year ended March 31, 2022, representing substantial growth over the previous year with receipt of few large value domestic orders. No major export order received during the year.

The segment recorded order inflow of ₹ 5,377 crore during the quarter ended March 31, 2022, registering a robust growth over the corresponding quarter of the previous year, with the booking of a large value order in the shipbuilding business unit.

The order book of the segment was at ₹ 12,537 crore as on March 31, 2022, with export orders constituting 4% of the total order book.

For the year ended March 31, 2022, the customer revenues at ₹ 3,218 crore registered a y-o-y decline of 5% over the previous year with tapering off large value orders under execution, coupled with delayed receipt of new awards. Export revenues constituted 13% of the total customer revenue of the segment.

The segment recorded customer revenues of ₹ 894 crore during the quarter ended March 31, 2022, recording a y-o-y decline of 21%. The share of export revenues was 4% of the total customer revenues for the quarter.

The EBITDA margin for the year ended March 31, 2022 at 20.2% was lower when compared to 22.2% in the previous year. The margins in the previous year had the benefit of release of cost savings in some key projects that got completed.

IT & Technology Services (IT&TS) Segment

The segment comprises 3 listed subsidiaries viz., (a) Larsen & Toubro Infotech Limited

(“LTI”) (b) L&T Technology Services and (c) Mindtree (“MT”).

The Boards of LTI and MT in their respective board meetings held on May 06, 2022 have approved the scheme of merger of the two companies subject to receipt of respective shareholders, creditors and regulatory approvals.

The segment recorded customer revenues of ₹ 32,256 crore for the year ended March 31, 2022, registering a y-o-y growth of 27% reflecting the continuing growth momentum in the sector with surge in demand for technology focused offerings. During the year, LTI completed a major milestone of revenue crossing USD 2 billion and MT crossing the

₹ 100 billion mark. Export sales constituted 93% of the total customer revenues of the segment for the year ended March 31, 2022.

The segment recorded customer revenues of ₹ 8,761 crore for the quarter ended March 31, 2022, recording q-o-q growth of 4% & y-o-y growth of 30%. International billing contributed 93% of the total customer revenues. In USD terms, the segment revenues of 1,186 million for the quarter grew 4% and 27% on a q-o-q and y-o-y basis, respectively.

The EBITDA margin for the segment at 23.6% for the year ended March 31, 2022, is in line with previous year at 23.5% as gains through better resource utilization got off-set by higher employee costs.

Financial Services Segment

The segment reflects the performance of L&T Finance Holdings, a listed subsidiary. The segment recorded income from operations at ₹ 11,971 crore during the year ended March 31, 2022, registering a y-o-y decline of 11%, mainly attributed to the targeted reduction in the overall loan book.

The segment recorded income from operations at ₹ 2,963 crore during the quarter ended March 31, 2022, registering a y-o-y decline of 12%.

The Loan Book decreased to ₹ 88,341 crore as compared with March 2021 at ₹ 94,013 crore, reflecting a cautious lending approach, focus on collections, portfolio sell down and a phased liquidation of the de-focused business book.

The segment EBIT for the year ended March 31, 2022 increased to ₹ 1,470 crore as compared

to ₹ 1,286 crore in the previous year due to lower credit costs.

Developmental Projects Segment

The segment recorded customer revenues of ₹ 4,368 crore registering growth of 21% over the previous year, driven by a higher PLF in the Nabha Power plant and a gradual increase in metro ridership in Hyderabad.

For the quarter ended March 31, 2022, the customer revenues at ₹ 1,096 crore, recording marginal de-growth of 2% y-o-y.

The segment EBIT for the year ended March 31, 2022 registers a loss of ₹ 231 crore as compared to loss of ₹ 197 crore during the previous year. The decline is mainly on account of non-consolidation of Nabha Power profits with the Company’s decision to carry the investment at estimated realisable value.

“Others” Segment

“Others” segment comprises (a) Realty, (b) Construction & Mining Machinery, (c) Rubber Processing Machinery, (d) Industrial Valves, (e) Smart World and Communication businesses and (f) the newly launched digital platforms SuFin and EduTech.

Customer revenues during the year ended March 31, 2022 at ₹ 5,988 crore registered a growth of 2% over the previous year. Export sales constituting 8% of the total customer revenues of the segment during the year majorly pertains to export of Industrial Valves and Rubber Processing Machinery.

The customer revenues of this segment during the quarter ended March 31, 2022 at

₹ 1,825 crore, is in line with previous year. Export sales constituted 5% of the total customer revenues.

During the year ended March 31, 2022, the segment EBITDA margin at 17.4%, declined compared to 21% during the previous year, since it had benefit of gain on sale of the commercial property in Realty business.