- 85% of MRO spend still going abroad—time to change that!

- $2B MRO market to double by 2030

- 50% domestic by 2030

- Calls AIESL a national asset

- Runway still bumpy for indigenous private MROs

By Sangeeta Saxena

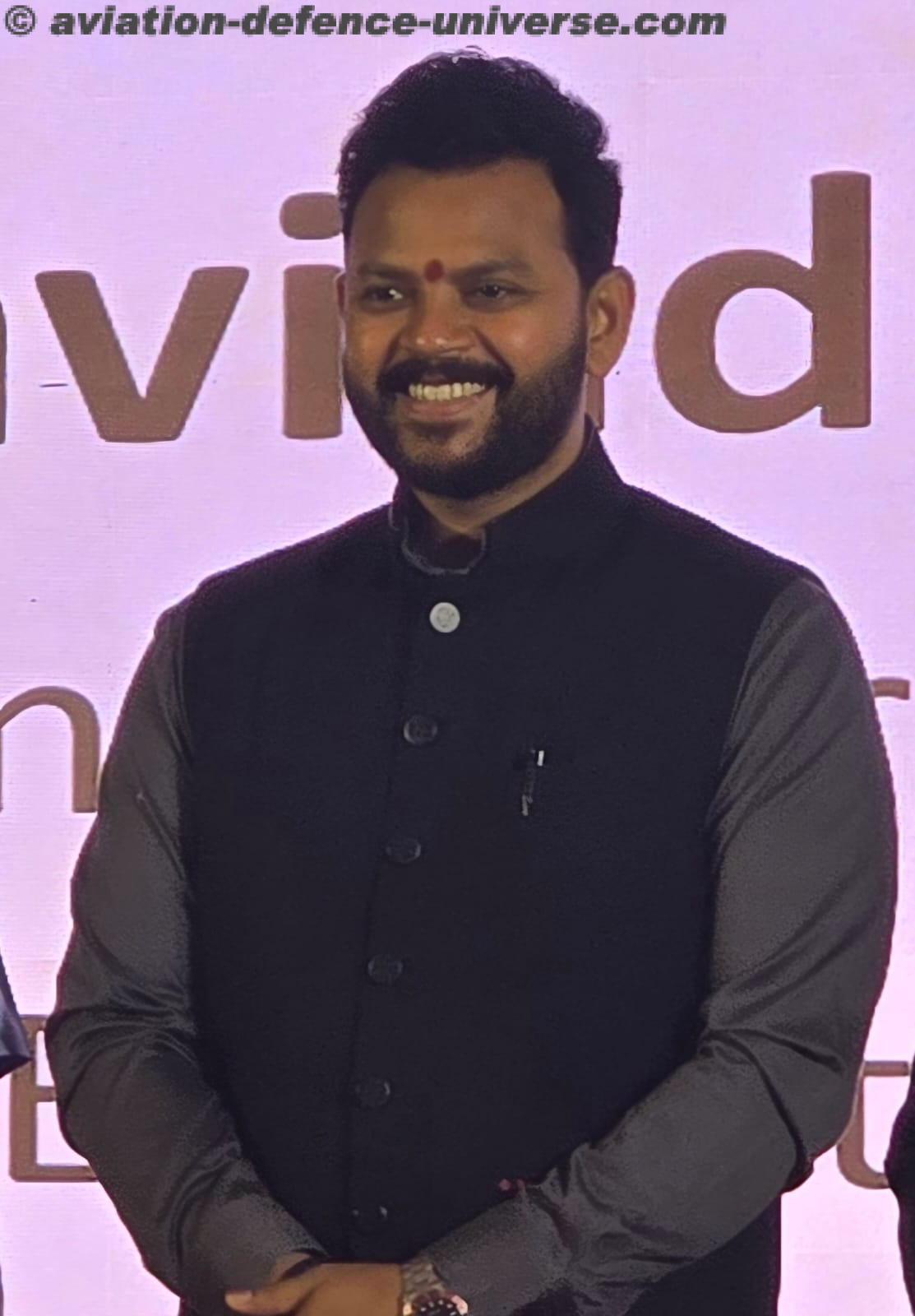

New Delhi. 29 April 2025. “The future of Indian aviation will not be decided by chance. It will be decided by our collective courage, collaboration and commitment,” exhorted Minister for Civil Aviation Rammohan Naidu Kinjarapu. He was speaking at the Aviation Horizon 2025 organised by AIESL—Air India Engineering Services Limited—the MRO (Maintenance, Repair and Overhaul) organisation which did not get dis-invested when Air India was bought over by Tatas.

“AIESL is not just another company,” the minister declared, “but a national asset, a symbol of India’s growing capability in the aviation sector.” With hangars across all major airports, AIESL services over 1,000 flight hours daily in line maintenance, handles over 300 flights through engine maintenance, and certifies more than 55,000 components each year. Its skilled workforce of over 5,000 professionals has helped generate ₹2,000 crore in annual revenue while significantly reducing India’s foreign exchange outflow.

But behind the optimism lies a critical imbalance. Despite a domestic MRO market valued at $2 billion—expected to double by 2030—India still outsources 85% of its MRO needs, with countries like Singapore, Malaysia, and the UAE reaping the benefits. “This is not just a statistic,” said Kinjarapu with urgency. “It is a call to action. Every rupee that is spent abroad is a missed opportunity for us in the country.”

But behind the optimism lies a critical imbalance. Despite a domestic MRO market valued at $2 billion—expected to double by 2030—India still outsources 85% of its MRO needs, with countries like Singapore, Malaysia, and the UAE reaping the benefits. “This is not just a statistic,” said Kinjarapu with urgency. “It is a call to action. Every rupee that is spent abroad is a missed opportunity for us in the country.”

India’s MRO sector has long been constrained by high taxation, regulatory hurdles, and a lack of scale. Although recent reforms—including 100% FDI under the automatic route and a uniform 5% GST on components—have started correcting the course, domestic providers still face challenges in competing with global giants.

In the civil aviation space, Indian carriers are poised to add 600 new aircraft in the next five years. With over 1,700 planes already on order, the demand for MRO services is set to surge. “We are projected to hit 300 million passengers by 2030,” noted the Minister. “85 new airports have come up in the last decade, and 200 more are planned over the next 20 years.”

On the military front, the story is nuanced. India has made headway in self-reliance under the ‘Atmanirbhar Bharat’ initiative. However, military MRO remains largely under the purview of defence PSUs, and private participation is still emerging. There is enormous potential for synergy between the civil and military segments, particularly in sharing infrastructure, workforce, and advanced technologies.

The Minister outlined a strategic vision to bridge these gaps. “We must align all our efforts in five key focus areas. These include embracing AI-driven predictive maintenance and cloud-based systems, deepening defence-civil integration, launching green MRO initiatives, investing in talent development, and ensuring diversity—specifically targeting a 25% women workforce in MRO roles. To meet its ambitions, India must not only retain domestic MRO business but become an export powerhouse. By 2030, we must increase India’s share of MRO spending from 14% to at least 50%. We must move beyond labour-intensive work. We must create intellectual property, lead in smart maintenance technologies and aviation innovation,” he stated.

“The regulatory landscape has also evolved. New legislation like the Bharatiya Vayuyan Adhiniyam 2024 and the Protection of Interests in Aircraft Objects 2025 are designed to bolster India’s capabilities in aircraft leasing, financing, and in-country design and manufacturing. We have aided for more MRO facilities to be started in the country. And how did we do it? 100% FDI is permitted in MRO services via the automatic route. Uniform 5% GST on aircraft components, saving the airline industry over 1000 crores annually has been done. Royalty charges have been abolished for MROs. Zero rated GST for work subcontracted by foreign OEMs to Indian MROs. And export timelines have been extended from 6 months to 1 year for repair goods and from 3 years to 5 years for warranty repairs. Reforms in Aircraft Rules 1937, extending AME licence validity from 5 years to 10 years at no extra cost has also been done. And harmonisation of DGCA regulations with EASA and ICAO guidelines have also been done. And most importantly, the Bharatiya Vayuyan Adhiniyam 2024 gives India a world class regulatory framework not only for manufacturing and maintenance but also for design of aircrafts and components domestically. Similarly, the Protection of Interests in Aircraft Objects 2025, which was enacted, established a robust legal foundation for aircraft leasing and financing in the country. So the runway is ready, the winds are favourable and now it is time for full throttle for all of us,” the Minister for Civil Aviation informed with elan’ and expected the industry to take things forward from here.

“The regulatory landscape has also evolved. New legislation like the Bharatiya Vayuyan Adhiniyam 2024 and the Protection of Interests in Aircraft Objects 2025 are designed to bolster India’s capabilities in aircraft leasing, financing, and in-country design and manufacturing. We have aided for more MRO facilities to be started in the country. And how did we do it? 100% FDI is permitted in MRO services via the automatic route. Uniform 5% GST on aircraft components, saving the airline industry over 1000 crores annually has been done. Royalty charges have been abolished for MROs. Zero rated GST for work subcontracted by foreign OEMs to Indian MROs. And export timelines have been extended from 6 months to 1 year for repair goods and from 3 years to 5 years for warranty repairs. Reforms in Aircraft Rules 1937, extending AME licence validity from 5 years to 10 years at no extra cost has also been done. And harmonisation of DGCA regulations with EASA and ICAO guidelines have also been done. And most importantly, the Bharatiya Vayuyan Adhiniyam 2024 gives India a world class regulatory framework not only for manufacturing and maintenance but also for design of aircrafts and components domestically. Similarly, the Protection of Interests in Aircraft Objects 2025, which was enacted, established a robust legal foundation for aircraft leasing and financing in the country. So the runway is ready, the winds are favourable and now it is time for full throttle for all of us,” the Minister for Civil Aviation informed with elan’ and expected the industry to take things forward from here.

The recently appointed and AIESL’s boss at the helm , Amit Kumar, Chairman of AI Engineering Services Limited (AIESL), during his keynote address at Aviation Horizon 2025, urged all stakeholders—from airlines to MRO companies—to move away from silos and come together to create a seamless ecosystem.

The recently appointed and AIESL’s boss at the helm , Amit Kumar, Chairman of AI Engineering Services Limited (AIESL), during his keynote address at Aviation Horizon 2025, urged all stakeholders—from airlines to MRO companies—to move away from silos and come together to create a seamless ecosystem.

“Working in isolation won’t help us achieve the Udaan we envision. AIESL, along with group companies like AIAHL and AIESL, can serve as the bridge between regulators, OEMs, and service providers. Together, we can drive meaningful policy reform and operational synergy. We must move from reactive and preventive maintenance models to predictive systems. Technology adoption is not optional—it’s essential,” he said.

He further added that engine overhauls, cable refurbishments, and passenger-to-freight conversions are just a few of the new revenue streams AIESL is actively exploring in collaboration with private player Touting AIESL’s strengths, Kumar shared that the company commands nearly 70% of the non-captive MRO market, supported by licensed manpower, engine overhaul shops, and a regulation-compliant infrastructure.

“Our workforce is our biggest asset—dedicated, experienced, and aligned with global standards. Under the Ministry’s direction, we are transforming into a business-oriented, professional MRO provider. We intend to make AIESL a billion-dollar company in the next 4 to 5 years.This is not just about AIESL—it’s about India’s future in aviation. We have the talent, infrastructure, and vision. Now we need to act as one industry,” Kumar concluded.

“India is no longer catching up in aviation—we are ready to lead,” said Sharad Agarwal, CEO of AI Engineering Services Limited (AIESL), addressing industry leaders at the Aviation Horizon 2025 conference. “With over six decades of experience, a nationwide footprint, and unmatched MRO capabilities, AIESL is firmly positioned as the anchor of India’s aviation growth story. Today, it services over 3,000 flights a month, offers line and base maintenance at major airports, and oversees complex overhauls that very few in the region can match. We bring a competitive advantage with our 5,000-strong workforce spread across 80 cities. Nearly 80% of our team are skilled technical professionals with an average of 22 years of experience,” he stated.

“India is no longer catching up in aviation—we are ready to lead,” said Sharad Agarwal, CEO of AI Engineering Services Limited (AIESL), addressing industry leaders at the Aviation Horizon 2025 conference. “With over six decades of experience, a nationwide footprint, and unmatched MRO capabilities, AIESL is firmly positioned as the anchor of India’s aviation growth story. Today, it services over 3,000 flights a month, offers line and base maintenance at major airports, and oversees complex overhauls that very few in the region can match. We bring a competitive advantage with our 5,000-strong workforce spread across 80 cities. Nearly 80% of our team are skilled technical professionals with an average of 22 years of experience,” he stated.

He claimed, that from sophisticated engine overhauls to landing gear repairs, and from attack computers to automatic testing equipment, AIESL is the only Indian MRO operating in such critical segments at this scale. The company holds certifications from DGCA, FAA, and other global regulatory bodies, enabling it to offer world-class quality and safety standards.

Highlighting AIESL’s infrastructure, Agarwal noted the company’s three world-class engine shops, including a flagship facility in Nagpur, which was developed with a capital investment of ₹350,000 crore is an asset to indigenous MRO activity and the Mumbai hangar, one of the oldest and most iconic in the country, still supports heavy aircraft operations.

“We’re not just about maintaining new jets—we still maintain legacy aircraft like the B737-200, which is over 40 years old, and even the B707, last serviced in 2018,” he said with pride. “We were pioneers in servicing A320s, B777s, and B787s in India.”

AIESL’s component maintenance wing certifies over 55,000 parts annually, while its CAMO (Continuing Airworthiness Management Organisation) services, lease return programs, and training schools in four cities add critical value for clients in India and abroad. “We’re focused on reducing turnaround time and offering first-off solutions to customers—this is how we aim to match and exceed global benchmarks.”

AIESL’s component maintenance wing certifies over 55,000 parts annually, while its CAMO (Continuing Airworthiness Management Organisation) services, lease return programs, and training schools in four cities add critical value for clients in India and abroad. “We’re focused on reducing turnaround time and offering first-off solutions to customers—this is how we aim to match and exceed global benchmarks.”

While the government’s push to develop India into a global MRO hub is gathering momentum—bolstered by initiatives from public sector giants like AIESL—the road ahead remains bumpy for private sector MROs. Challenges such as high taxation on imported spare parts, infrastructure bottlenecks, limited access to OEM licenses, and a lack of scale continue to hamper competitiveness. It is no secret that AAI (Airports Authority of India) rentals are the highest globally, which prevent new MROs from setting shops and older ones to continue. Additionally, uneven playing fields between government-backed and private MRO players often restrict market penetration for independent firms.

Despite the optimism surrounding policy reforms and industry collaborations, private MROs must navigate complex regulatory environments, attract skilled manpower, and build costly certifications from global aviation authorities to gain credibility. For India to truly become a global MRO destination, the ecosystem must ensure that private players are not just participants—but equal partners in growth. While the vision of making India a global MRO hub is commendable, private players still face significant headwinds. From high import duties on parts to the struggle for OEM approvals and an uneven policy landscape, the odds are stacked. Unless there is a deliberate push to level the playing field, private MROs will find it hard to scale sustainably and compete globally. The million dollar question which remains is can Indian MRO ecosystem develop with such issues remaining unsolved?

Despite the optimism surrounding policy reforms and industry collaborations, private MROs must navigate complex regulatory environments, attract skilled manpower, and build costly certifications from global aviation authorities to gain credibility. For India to truly become a global MRO destination, the ecosystem must ensure that private players are not just participants—but equal partners in growth. While the vision of making India a global MRO hub is commendable, private players still face significant headwinds. From high import duties on parts to the struggle for OEM approvals and an uneven policy landscape, the odds are stacked. Unless there is a deliberate push to level the playing field, private MROs will find it hard to scale sustainably and compete globally. The million dollar question which remains is can Indian MRO ecosystem develop with such issues remaining unsolved?