Bengaluru, India, Wednesday, 13 November 2024: AXISCADES Technologies Ltd. (BSE: 532395 | NSE: AXISCADES), a leading end to end technology and engineering solutions provider, catering to Aerospace, Defence, Heavy Engineering, Automotive, Energy, and Semiconductor industries serving Global OEMs, today announced results for the quarter ended September 30, 2024.

Key Financial Highlights: Q2 FY25

|

Revenue ₹ 264 crores |

|

EBITDA ₹ 33 crores |

|

PAT ₹ 12 crores |

Key Financial Highlights: H1 FY25

|

Revenue ₹ 488 crores |

|

EBITDA ₹ 64 crores |

|

PAT ₹ 29 crores |

Consolidated Financial Highlights

(all numbers in INR crores except % data)

|

Particulars |

Q2 FY24 |

Q1 FY25 |

Q2 FY25 |

YoY |

QoQ |

H1 FY25 |

H1 FY24 |

YoY |

|

Revenue from Operations |

251 |

223 |

264 |

5.1% |

18.4% |

488 |

465 |

4.8% |

|

EBITDA |

36 |

31 |

33 |

-8.6% |

5.4% |

64 |

69 |

-7.3% |

|

EBITDA Margin |

14.2% |

13.9% |

12.4% |

|

|

13.1% |

14.8% |

|

|

Profit after Tax |

11 |

17 |

12 |

9.7% |

-27.0% |

29 |

17 |

71.9% |

|

PAT Margin |

4.4% |

7.2% |

4.6% |

|

|

6.0% |

3.6% |

|

Business Highlights

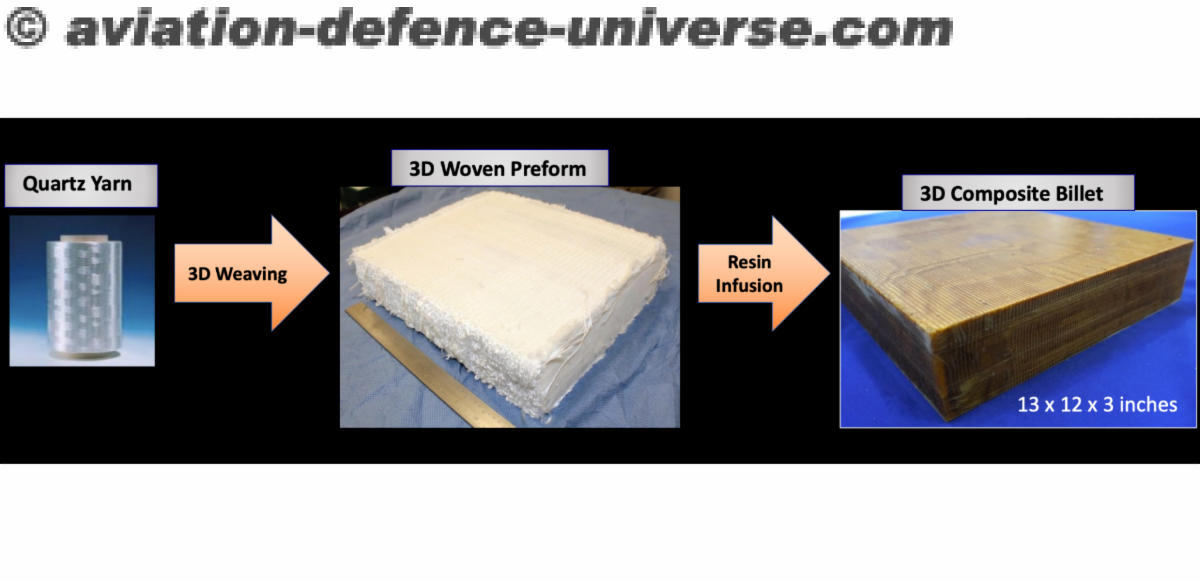

Aerospace

- 19% growth YoY driven by increase in wallet share with European OEM.

- Ramp up in new geography – notably North America and India.

- Increased areas of service – manufacturing support and final assembly lines.

- Plant shutdowns with OEM resulted in slowdown during Q2 resulting in flat QoQ.

Defence

- 121 crores added to orderbook in Q2’25.

- Production revenues increased 84% QoQ indicating execution of design wins from the past and orderbook expansion.

- ₹78Cr production revenues booked in H1’25.

Semiconductor

- 36% growth QoQ driven by design revenues and return of traditional revenue lines from manufacturer.

- Significant use case development and testing with customers in the vertical

Energy

- 100% YOY growth driven by EPCOGEN enabled accounts as well as organic growth in inhouse engagements.

- QoQ growth of 7% on a consol basis and 25% on organic accounts.

- Selected as the exclusive engineering partner on 2 new projects in UK with renewable energy solution provider (TCV – $3m).

Heavy Engineering

- Increased our engagement with global off highway OEM on both plant and vehicle manufacturing.

- Marginal QoQ growth 3% indicating turnaround in business engagement and alignment to customer strategy

Automotive

- QoQ and YoY decline due to macro challenges on global scale and with European OEMs due to sluggishness in EV space.

- Change in quality of engagement with UK OEM focused on cybersecurity and system testing.

- Pivoting from mechanical to digital and embedded solutions

Financial Highlights

• Revenue ₹264 crores; up 18.4% QoQ

• Total order book at $89 Mn up 17% QoQ

• EBITDA at ₹33 crores; up 74% QoQ on adjusted EBITDA

• EBITDA Margins at 12.4%; expanded 400bps QoQ on adjusted EBITDA

• PAT at ₹12 crores; up 20% QoQ on adjusted PAT

• Q2 Defence order intake ₹121 crores.

• Net Debt at ₹55 crores

• Cash, bank and liquid investments at ₹125 crores

Commenting on the results and outlook, Mr. Arun Krishnamurthi, CEO & MD of AXISCADES said,

“For Q2 FY25, the company achieved resilient performance, with sales revenue of ₹264 crore, recording 18% sequential growth. This was complemented by an EBITDA of ₹33 crore and a PAT of ₹12 crore, reflecting strong operational efficiency, despite macroeconomic challenges in certain verticals. This performance underscores our ability to navigate a dynamic market environment, while delivering value to our stakeholders.

The revenue growth was driven both by Digital Engineering Services and Defence. In engineering services, Aerospace segment demonstrated a robust 19% YoY growth. Defence revenues grew by a healthy 73% QoQ, with Defence production revenues surging by 84% QoQ, bolstered by a significant order backlog set for execution in fiscal years 2025 & 2026.

However, automotive vertical continues to face macro challenges, which adversely impacted revenue and margins in the second quarter. With second largest outsourced ER&D spend in automotive, we are bullish on this vertical returning to growth in early FY26. We remain committed and confident of addressing these challenges and will continue to focus on strengthening the business to achieve sustainable growth & profitability”.