- Market environment strongly impacted by COVID-19 situation, particularly in commercial aircraft

- Q1 2020 financials partially impacted by COVID-19

- Revenues € 10.6 billion; EBIT Adjusted € 281 million

- EBIT (reported) € 79 million; loss per share (reported) € -0.61

- Free cash flow before M&A and customer financing € -8.0 billion / € -4.4 billion before payment of € -3.6 billion penalties

- Strong focus on matching production to demand and cash containment

- Assessment of COVID-19 implications on outlook in progress.

- No new guidance issued given limited visibility

Amsterdam. 29 April 2020. Airbus SE (stock exchange symbol: AIR) reported consolidated financial results for its First Quarter (Q1) ended 31 March 2020.

“We saw a solid start to the year both commercially and industrially but we are quickly seeing the impact of the COVID-19 pandemic coming through in the numbers,” said Airbus Chief Executive Officer Guillaume Faury. “We are now in the midst of the gravest crisis the aerospace industry has ever known. We’re implementing a number of measures to ensure the future of Airbus. We kicked off early by bolstering available liquidity to support financial flexibility. We’re adapting commercial aircraft production rates in line with customer demand and concentrating on cash containment and our longer-term cost structure to ensure we can return to normal operations once the situation improves. At all times, the health and safety of Airbus’ employees is our top priority. Now we need to work as an industry to restore passenger confidence in air travel as we learn to coexist with this pandemic. We’re focused on the resilience of our company to ensure business continuity.”

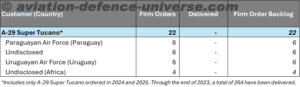

Net commercial aircraft orders totalled 290 (Q1 2019: -58 aircraft) with the order backlog comprising 7,650 commercial aircraft as of 31 March 2020. Airbus Helicopters booked 54 net orders (Q1 2019: 66 units), including 21 H145s, 15 UH-72 Lakotas for the US Army and 2 Super Pumas. Airbus Defence and Space’s order intake of € 1.7 billion included military aircraft-related services, new contract wins in telecommunications and in connected intelligence. Also included is the Phase 1A demonstrator contract for Europe’s Future Combat Air Systems programme.

Consolidated revenues decreased to € 10.6 billion (Q1 2019: € 12.5 billion), reflecting the difficult market environment impacting the commercial aircraft business with 40 less deliveries than a year earlier, partly offset by a better mix and more favourable foreign exchange environment. A total of 122 commercial aircraft were delivered (Q1 2019: 162 aircraft), comprising 8 A220s, 96 A320 Family, 4 A330s and 14 A350s. Airbus Helicopters delivered 47 rotorcraft (Q1 2019: 46 units) with its 19% increase in revenues reflecting the favourable delivery mix and growth in services. Revenues at Airbus Defence and Space were stable year-on-year. One A400M transport aircraft was delivered in the quarter.

Consolidated EBIT Adjusted – an alternative performance measure and key indicator capturing the underlying business margin by excluding material charges or profits caused by movements in provisions related to programmes, restructurings or foreign exchange impacts as well as capital gains/losses from the disposal and acquisition of businesses – declined to € 281 million (Q1 2019: € 549 million), mainly driven by Airbus.

Airbus’ EBIT Adjusted of € 191 million (Q1 2019: € 463 million(1)) mainly reflected the lower commercial aircraft deliveries and associated costs, partly offset by positive foreign exchange effects.

Airbus delivered further industrial progress in the first quarter, however around 60 aircraft could not be delivered due to the COVID-19 pandemic. As announced in early April, due to the COVID-19 situation average monthly aircraft production rates are being adjusted to 40 for the A320 Family, 2 for the A330 and 6 for the A350. This represents a reduction of roughly one third compared to pre-crisis average production rates. On the A220, the Final Assembly Line in Mirabel, Canada, is expected to progressively return to a monthly rate of 4 aircraft.

Airbus Helicopters’ EBIT Adjusted increased to € 53 million (Q1 2019: € 15 million), reflecting the favourable delivery mix and growth in its services business.

EBIT Adjusted at Airbus Defence and Space decreased to € 15 million (Q1 2019: € 101 million), reflecting the lower business performance, including in Space Systems. Due to the severity of the coronavirus pandemic, the incremental impact on the business is being assessed and the restructuring plan at Defence and Space will be adjusted accordingly.

Consolidated self-financed R&D expenses totalled € 663 million (Q1 2019: € 654 million).

Consolidated EBIT (reported) was € 79 million (Q1 2019: € 181 million), including Adjustments totalling a net € -202 million. These Adjustments comprised:

€ -33 million related to A380 programme cost;

€ -134 million related to the dollar pre-delivery payment mismatch and balance sheet revaluation;

€ -35 million of other costs, including compliance costs.

The consolidated reported loss per share of € -0.61 (Q1 2019 earnings per share: € 0.05) includes the financial result of € -477 million (Q1 2019: € -43 million). The financial result includes a net € -245 million related to Dassault Aviation financial instruments and € -136 million from the full impairment of a loan to OneWeb, which filed for Chapter 11 bankruptcy proceedings in late March. The consolidated net loss(2) was € -481 million (Q1 2019 net income: € 40 million).

Consolidated free cash flow before M&A and customer financing amounted to € -8,030 million (Q1 2019: € -4,341 million) and included the payment of € -3.6 billion in penalties related to January 2020’s compliance agreement with the authorities. Despite the lower commercial aircraft deliveries and the significant inventory build-up, free cash flow before M&A and customer financing was at a similar level compared to the first quarter of 2019 when excluding the penalty payment. Consolidated free cash flow was € -8,501 million (Q1 2019: € -4,448 million). The consolidated net cash position was € 3.6 billion on 31 March 2020 (year-end 2019: € 12.5 billion) with a gross cash position of € 18.4 billion (year-end 2019: € 22.7 billion).

Given the current COVID-19 environment, various measures were announced in late March 2020 to protect the Company’s financial liquidity and continue to fund its operations. These included securing a new credit facility amounting to € 15 billion, withdrawing the 2019 dividend proposal and suspending the voluntary top up in pension funding. In addition, a € 2.5 billion bond was issued, partially terming out the € 15 billion credit facility, and settled on 7 April 2020. In coming quarters, the Company will continue to focus on cash preservation and will be reducing cash outflows. Besides reducing expected 2020 capital expenditure by around € 700 million to around € 1.9 billion, the activated measures also include the deferral and suspension of activities which are not critical to business continuity and to meeting customer and compliance commitments.

The 2020 guidance was also withdrawn in March. The impact of COVID-19 on the business continues to be assessed and given the limited visibility, in particular with respect to the delivery situation, no new guidance is issued.

Consolidated Airbus – First Quarter (Q1) Results 2020

(Amounts in Euro)

| Consolidated Airbus | Q1 2020 | Q1 2019 | Change |

| Revenues, in millions | 10,631 | 12,549 | -15% |

| thereof defence, in millions | 1,946 | 1,678 | +16% |

| EBIT Adjusted, in millions | 281 | 549 | -49% |

| EBIT (reported), in millions | 79 | 181 | -56% |

| Research & Development expenses, in millions |

663 | 654 | +1% |

| Net Income/Loss(2), in millions | -481 | 40 | – |

| Earnings/Loss Per Share | -0.61 | 0.05 | – |

| Free Cash Flow (FCF), in millions | -8,501 | -4,448 | – |

| Free Cash Flow before M&A, in millions |

-7,999 | -4,393 | – |

| Free Cash Flow before M&A and Customer Financing, in millions |

-8,030 | -4,341 | – |

| Consolidated Airbus | 31 March 2020 |

31 Dec 2019 |

Change |

| Net Cash position, in millions | 3,586 | 12,534 | -71% |

| Employees | 136,518 | 134,931 | +1% |

| By Business Segment | Revenues | EBIT (reported) | ||||

| (Amounts in millions of Euro) | Q1 2020 |

Q1 2019(1) |

Change | Q1 2020 |

Q1 2019(1) |

Change |

| Airbus | 7,569 | 9,697 | -22% | 57 | 319 | -82% |

| Airbus Helicopters | 1,202 | 1,007 | +19% | 53 | 9 | +489% |

| Airbus Defence and Space | 2,111 | 2,112 | 0% | -53 | -117 | – |

| Eliminations | -251 | -267 | – | 22 | -30 | – |

| Total | 10,631 | 12,549 | -15% | 79 | 181 | -56% |

| By Business Segment | EBIT Adjusted | ||

| (Amounts in millions of Euro) | Q1 2020 |

Q1

2019(1) |

Change |

| Airbus | 191 | 463 | -59% |

| Airbus Helicopters | 53 | 15 | +253% |

| Airbus Defence and Space | 15 | 101 | -85% |

| Eliminations | 22 | -30 | – |

| Total | 281 | 549 | -49% |

| By Business Segment | Order Intake (net) | Order Book | ||||

| Q1 2020 |

Q1 2019 |

Change | 31 March 2020 |

31 March 2019 |

Change | |

| Airbus, in units | 290 | -58 | – | 7,650 | 7,357 | +4% |

| Airbus Helicopters, in units | 54 | 66 | -18% | 702 | 737 | -5% |

| Airbus Defence and Space, in millions of Euro | 1,734 | 1,074 | +61% | 31,921 | 34,074 | -6% |

EBIT (reported) / EBIT Adjusted Reconciliation

The table below reconciles EBIT (reported) with EBIT Adjusted.

| Consolidated Airbus

(Amounts in millions of Euro) |

Q1 2020 |

| EBIT (reported) | 79 |

| thereof: | |

| A380 programme cost | -33 |

| $ PDP mismatch/balance sheet revaluation | -134 |

| Others | -35 |

| EBIT Adjusted | 281 |

Glossary

| KPI | DEFINITION |

| EBIT | The Company continues to use the term EBIT (Earnings before interest and taxes). It is identical to Profit before finance result and income taxes as defined by IFRS Rules. |

| Adjustment | Adjustment, an alternative performance measure, is a term used by the Company which includes material charges or profits caused by movements in provisions related to programmes, restructurings or foreign exchange impacts as well as capital gains/losses from the disposal and acquisition of businesses. |

| EBIT Adjusted | The Company uses an alternative performance measure, EBIT Adjusted, as a key indicator capturing the underlying business margin by excluding material charges or profits caused by movements in provisions related to programmes, restructurings or foreign exchange impacts as well as capital gains/losses from the disposal and acquisition of businesses. |

| EPS Adjusted | EPS Adjusted is an alternative performance measure of basic earnings per share as reported whereby the net income as the numerator does include Adjustments. For reconciliation, see the Analyst presentation. |

| Gross cash position | The Company defines its consolidated gross cash position as the sum of (i) cash and cash equivalents and (ii) securities (all as recorded in the consolidated statement of financial position). |

| Net cash position | For the definition of the alternative performance measure net cash position, see Universal Registration Document, MD&A section 2.1.6. |

| FCF | For the definition of the alternative performance measure free cash flow, see Universal Registration Document, MD&A section 2.1.6.1. It is a key indicator which allows the Company to measure the amount of cash flow generated from operations after cash used in investing activities. |

| FCF before M&A | Free cash flow before mergers and acquisitions refers to free cash flow as defined in the Universal Registration Document, MD&A section 2.1.6.1 adjusted for net proceeds from disposals and acquisitions. It is an alternative performance measure and key indicator that reflects free cash flow excluding those cash flows resulting from acquisitions and disposals of businesses. |

| FCF before M&A and customer financing | Free cash flow before M&A and customer financing refers to free cash flow before mergers and acquisitions adjusted for cash flow related to aircraft financing activities. It is an alternative performance measure and indicator that may be used from time to time by the Company in its financial guidance, especially when there is higher uncertainty around customer financing activities. |