- Marks 15th consecutive month of growth

Geneva. 03 December 2024 . The International Air Transport Association (IATA) released data for October 2024 global air cargo markets showing continuing strong annual growth in demand.

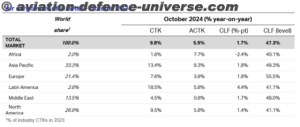

- Total demand, measured in cargo tonne-kilometers (CTKs*), rose by 9.8% compared to October 2023 levels (10.3% for international operations) for a 15th consecutive month of growth.

- Capacity, measured in available cargo tonne-kilometers (ACTKs), increased by 5.9% compared to October 2023 (7.2% for international operations). This was largely driven by an 8.5% increase in international belly capacity. Dedicated freighter capacity increased by 5.6%, the seventh consecutive month of growth with volumes nearing 2021 peak levels.

“Air cargo markets continued their strong performance in October, with demand rising 9.8% year-on year and capacity up 5.9%. Global air cargo yields (including surcharges) continue to rise, up 10.6% on 2023 and 49% on 2019 levels. While 2024 is shaping up to be a banner year for air cargo, we must look to 2025 with some caution. The incoming Trump Administration’s announced intention to impose significant tariffs on its top trading partners—Canada, China and Mexico—has the potential to upend global supply chains and undermine consumer confidence. The air cargo industry’s proven adaptability to rapidly evolving geopolitical and economic situations is likely to be tested as the Trump agenda unfolds,” said Willie Walsh, IATA’s Director General.

Several factors in the operating environment should be noted:

- Year-on-year, industrial production rose 1.6% in September while global goods trade increased 2.4% for a sixth consecutive month of growth. The increase in trade is partly due to businesses stockpiling inventory ahead of potential disruptions, like the US port strike.

- Global manufacturing activity rebounded in October. The Purchasing Managers Index (PMI) for global manufacturing output was above the 50-mark, indicating growth. However, the PMI for new export orders, remained below the 50-mark, suggesting ongoing uncertainty and weakness in global trade.

- US headline inflation, based on the annual Consumer Price Index (CPI), rose by 0.17 percentage points to 2.58% in October, ending a six-month decline. In the same month, the inflation rate in the EU increased by 0.24 percentage points to 2.33%. China’s consumer inflation fell to 0.29% in October, sparking concerns of an economic slowdown.

Air Cargo Demand up 9.8% in October 2024 – 15th Month of Consecutive Growth

October Regional Performance

Asia-Pacific airlines saw 13.4% year-on-year demand growth for air cargo in October. Capacity increased by 9.3% year-on-year.

North American carriers saw 9.5% year-on-year demand growth for air cargo in October. Capacity increased by 5.8% year-on-year.

European carriers saw 7.6% year-on-year demand growth for air cargo in October. Capacity increased 3.9% year-on-year.

Middle Eastern carriers saw 4.5% year-on-year demand growth for air cargo in October. Capacity increased 0.8% year-on-year.

Latin American carriers saw 18.5% year-on-year demand growth for air cargo in October, the strongest growth among the regions. Capacity increased 5.8% year-on-year.

African airlines saw 1.6% year-on-year demand growth for air cargo in October, the slowest among regions. Capacity increased by 7.7% year-on-year.

Trade Lane Growth: International routes experienced exceptional traffic levels for the fifth consecutive month with a 10.3% year-on-year increase in October. Airlines are benefiting from rising e-commerce demand in the US and Europe amid ongoing capacity limits in ocean shipping.

| Trade Lane | Growth | Notes | Share |

| Asia-North America | +8.6% | 12 consecutive

months of growth |

25.00% |

| Europe-Asia | +14.3% | 20 consecutive

months of growth |

19.40% |

| Middle East -Europe | +15.3% | 15 consecutive

months of growth |

5.00% |

| Middle East-Asia | +9.0% | 17 consecutive

months of growth |

7.20% |

| Within Asia | +15% | 12 consecutive

months of growth |

6.70% |

| North America Europe | +8.6% | 12 consecutive

months of growth |

14.30% |

| Africa-Asia | +13.3% | 14 consecutive

months of growth |

1.26% |